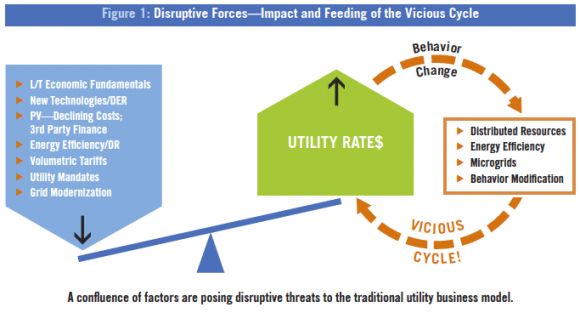

Two years ago, energy investment veteran Peter Kind wrote a report for the Edison Electric Institute, suggesting that utilities need to be freed to develop alternative business models to deal with the threat of third-party distributed energy. Among the new revenue streams, tariff structures and cost-sharing mechanisms the report put on the table, there were some ideas that have drawn fire from the solar industry, such as reducing compensation for net-metered solar customers.

But none has proven as unpopular as fixed charges for solar-equipped or net-metered customers. That’s why Kind’s latest report, Pathway to a 21st Century Electric Utility Model, released Monday on behalf of sustainable investment nonprofit Ceres, takes it off the table.

That’s not to say that the pressure to find utility alternatives has eased, Kind said in a recent interview. In fact, with the Clean Power Plan, utilities face an entirely new set of uncertainties, as well as opportunities, in their clean energy futures, he said.

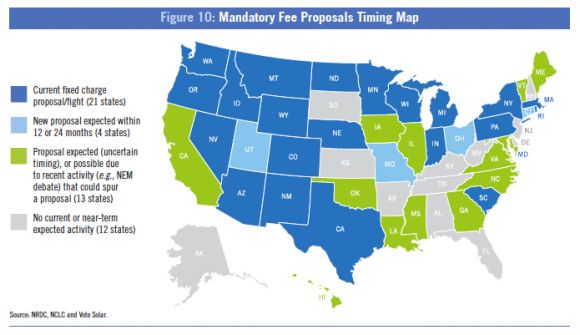

But fixed-charge proposals rolled out by vanguard utilities in the past two years have faced widespread opposition from solar advocates and the general public, as well as skepticism from regulators, he said. “Two years later, I’m thinking, 'Well, that’s pissing off a lot of people,'” he said.

What’s more, fixed charges are “not sending the right price signal,” he said, because they’re a cost that customers can’t reduce, no matter how efficiently they manage their electricity.

And where fixed charges have gone through, such as at Arizona utility Salt River Project, they’ve crimped the growth of solar significantly. That’s antithetical to the broader imperative to encourage clean energy, the report notes.

These are some of the reasons why utility Arizona Public Service has dialed back its original solar fixed-charge proposal. Instead, it’s asking state regulators to take up the issue of how to share costs across solar and non-solar customers in a future proceeding, meant to determine the true cost of serving the distribution grid.

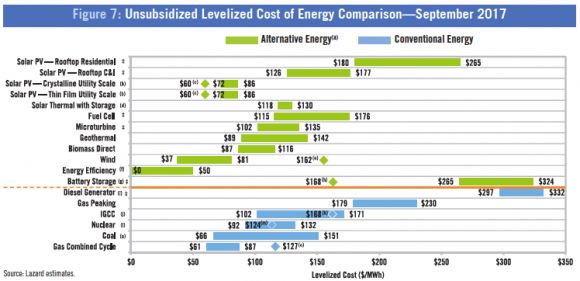

That’s the kind of work that could inform new ways to compensate net-metered solar customers, based on the value of the solar they generate. One idea is to stop paying net-metered customers the retail rate for the solar power they produce, and switch them to a rate set by competitive wholesale rates, or the “levelized cost of the lowest incremental cost to deploy efficient renewables” -- in other words, some kind of value-of-solar tariff.

This is similar to what Hawaii has done with net metering, and what California utilities are proposing in the state’s net metering 2.0 proceeding. These aren’t popular ideas with rooftop solar companies, however, because they will reduce revenues significantly -- in Hawaii and California, the utility proposals would pay roughly half the retail rates, on average.

Even so, “We can’t afford to buy the least efficient renewables,” Kind argued. “We need to find out what the most efficient renewables are, and the owner of those most efficient renewables should receive either the wholesale price for energy, or if it’s higher, the most efficient cost of renewables adjusted for getting it to your house.”

Community solar, which allows individuals to “own” a portion of a larger-scale solar system, can provide a more capital-efficient entry for homeowners and small businesses, he said. It could help expand the market to the roughly four-fifths of the population that lacks a proper roof for solar PV.

Tariff structures such as time-of-use rates could help encourage planning and investment in solar that more closely matches grid needs, as well as drive behavior change -- “If you’re going to use energy at the most expensive time of the day, you should pay for it,” he said. Bidirectional metering capabilities could allow compensation schemes that separate consumption and generation, he added.

Kind, the executive director of Energy Infrastructure Advocates and a former long-time energy and utilities investment director, also laid out some high-level ideas for loosening the linkage between utility capital investments and guaranteed rates of return. The report suggests the U.K.’s Totex (total expenditures) model, which includes incentives to consider operating investments that replace or defer capital investment, as one option. Regulators should also decouple utility revenues from energy sales, as states like California have done, to take away a direct disincentive for utilities to invest in energy efficiency.

Cost-of-service regulatory frameworks should be replaced with systems that allow utilities to earn incentives for exceeding expectations, along with penalties for not meeting them, he added. This is rare today, although states like Oklahoma and Ohio have made them part of specific utility smart-grid deployments, and Illinois lawmakers have ordered Commonwealth Edison to hit certain performance metrics for its 2.2-million-unit smart meter deployment.

As for new revenue streams, utilities could use their connections with customers, such as call centers and web portals, to open “app stores,” he said -- clearinghouses of utility and third-party energy services, that could earn revenues on a “per-click” basis. “Today, you can go to utility websites and learn about products, but you can’t click through, because there’s no incentive there,” he said.

In terms of how different states are realizing this vision, Kind said that New York’s Reforming the Energy Vision initiative seems to be relegating utilities to a role as a platform provider for third-party energy services companies, rather than as a participant. California’s wide-ranging reforms are “all interesting,” he said, though “I wish they’d come up with a comprehensive plan, rather than a bunch of mandates.” Minnesota’s e21 Initiative is also an interesting initiative, although it’s so far led by non-utility players, he said.

It's in everyone's interest to ensure that utilities remain financially healthy, given that they’re still going to be the provider of energy to the vast majority of people for decades to come -- claims of “grid defection” not withstanding, he said. Along with the net-metering challenges in solar-rich states like Hawaii, California and Arizona, utilities everywhere still face flat or declining energy demand, hundreds of billions of dollars in future infrastructure costs, and the mandate to fairly share costs across all customers.

“I think we’re going to need plenty of solar,” he said. “If the Clean Power Plan is implemented as proposed, we need all of it. The question is, at what price? Solar is a good proposition for many customers, no matter what the [net metering] rate might be. This doesn’t suggest the demise of rooftop. But if we’re using customers’ money, let’s spend it on the most efficient product available.”