We’re publishing the full series of both the videos and transcripts from all of the SaaStr Annual 2015 sessions (check out the Zenefits and Slack/Yammer posts if you missed them). Today we’ve got Mamoon Hamid, Co-founder and General Partner at Social+Capital, an early stage Venture Capital firm that funds breakthrough healthcare, education, financial services, mobile, and enterprise software companies. Mamoon has invested in and served on the boards of some of the most disruptive SaaS companies including Box, Yammer and Slack.

In this session, Mamoon walks us through some of the companies he’s invested in and delves into the reasons that Social+Capital chooses to invest or pass on an opportunity. Learn what tips him off that an investment might become a unicorn, which red flags have stopped him from making an offer, and learn how to calculate the Quick Churn Ratio that Social+Capital uses as a quick and easy benchmark to gauge the overall health of a recurring revenue model business.

Check out the full transcript from Mamoon’s session below!

Also, make sure you grab your ticket to the 2016 SaaStr Annual. Join 5K SaaS founders, execs, and investors for 3 full days of epic content and unparalleled networking. You definitely don’t want to miss it.

Mallun Yen: Mamoon, I know you’ve got a ton of incredible recurring revenue investments, so please give us a peek!

Mamoon Hamid: Thank you, Mallun. Just a brief introduction: I helped co-found Social+Capital about three and half years ago. We invest across health care, education and financial services as well as ente rprise. I lead our enterprise practice at Social+Capital.

rprise. I lead our enterprise practice at Social+Capital.

I’m going to talk about one thing and one thing only, which is this right here, since he has taken all the nuggets here… Seriously, I’m going to talk about MRR and churn.

Before I do that, I’d like to spend some time showcasing our portfolio of enterprise investments and how we generally think about the enterprise investment landscape. The way the framework is laid out, it’s the end user higher up the stack, the infrastructure, and the CIO further down the stack.

At the top of the stack, we look at software that every single employee at a company gets to use inside to be more productive. It’s email, it’s calendar, it’s all kinds of other tools, like Box, Yammer, Slack, things that you know well.

We love end-user-centric horizontal plays like that. We’ve heavily invested across those areas. Other areas that we really like are vertically, what are tools that individuals inside of our organization, a marketer, a salesperson, a recruiter, an engineer, a product manager, use on a daily basis to get their work done?

It’s almost like ‘What are the tools that they open up first thing in the morning and spend most of their time on during a given day?’ That’s the other thing we look at, and we love those kinds of businesses. We love tracking DAUs for our SaaS companies that fall into that bucket.

It’s companies like Clearside that salespeople use, or Intercom that a lot of marketers use, or Slack, that a lot of people in HR use. We really like companies that address applications catered toward the individual contributor.

As you go further down the stack, it’s less about the end user, and it’s more about the CIO. With the proliferation of all of these applications at the top end of the stack, there are issues with security and control.

CIOs have lost control over all of the sanctioned as well as the unsanctioned apps. In order to address that, we’ve invested in security and control companies like Netskope and OneLogin. In here, it’s more about reining in some of that control and bringing some of that power back to the CIO.

It’s, in some places, called Shadow IT, but we’ve made a few bets here as well, because I think it’s super important to address the needs of the CIO as BYOA and BYOD happens. Then as there’s an explosion of data in the stack above, you need to make better decisions. There’s analytics and BI in that, and the last layer is the data infrastructure that’s used to build all these software apps that are above. That’s sort of the general framework that we use.

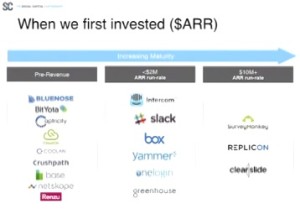

When do we invest in these companies? A simple way of breaking it out is really just there’s no revenue, there’s a little bit of revenue and there’s a lot of revenue. A lot of revenue for early stage investors is relative, but we look at pre-revenue companies. We look at companies with less than two million of revenue run rate and companies with more than a 10 million dollar run rate.

As we think about where we invest, we come with this prepared mind approach which is,  “Where is the white space? Where are the great opportunities to build very interesting large, sustainable, stand alone companies that can one day go public?” The way we form our views is by talking to a lot of entrepreneurs, talking to our portfolio companies, and just thinking about where world is going to be headed.

“Where is the white space? Where are the great opportunities to build very interesting large, sustainable, stand alone companies that can one day go public?” The way we form our views is by talking to a lot of entrepreneurs, talking to our portfolio companies, and just thinking about where world is going to be headed.

We continually evolve on that on our thesis areas, but really when we’re investing in a pre-revenue company, we’re talking about investing in a stellar team and investing in a target market where we have a lot of conviction. That’s typically a seed stage company where we’re investing a million dollars. It can be a Series A company where we’re investing a bit more because we know the entrepreneur and we have super conviction around their target market.

The next bucket over is where you have all of the characteristics from the left but also you have early product/market fit and the potential of a category-winning company. Here, we actually look for customer validation and we spend a lot of time talking to customers. In a lot of cases actually, customers end up being portfolio companies of ours or people that we know, so we can really credibly assess the veracity of the customer feedback.

To the right, we’re looking for companies where the business is compounding; it’s rapidly growing; it’s a clear category winner, and it has a clear path to being a unicorn or a…

Jason Green: Decacorn.

Mamoon: Yeah, that’s right. Let’s look at how we  map our portfolio to this structure. As you see, a lot of it is in the super early stage where we’ve seeded or done Series As. Quite a bit of companies are also in that middle category where there’s a little bit of revenue, but it’s really an indication of like these companies are really going to be the leaders.

map our portfolio to this structure. As you see, a lot of it is in the super early stage where we’ve seeded or done Series As. Quite a bit of companies are also in that middle category where there’s a little bit of revenue, but it’s really an indication of like these companies are really going to be the leaders.

To the right are companies that are already the leaders in their category and they have the potential of being a unicorn. This is actually where we first invested in these companies. The first check was written when the revenue scale was like this. As you know, many of these of these companies have moved on to become much bigger.

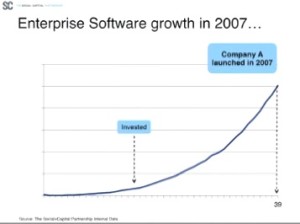

Now, we’re going to play a fun game of guess the company. This is a company that was started in 2005-6 but it really morphed into being an enterprise software company in 2007. We invested in the beginning of 2008 and it took them 39 months to get to 10 million in ARR. Any guesses? I’ll keep going, so think about it.

Jason Green: Can I guess?

Mamoon: No, because you know the company. Hint: The next company, launched in 2009… or launched their enterprise product in 2009. We invested in 2010. It took them 33 months to get to 10 million in ARR. Finally, third company launched in 2014. We invested in 2014, and took them 11 months to get to 10 million in ARR. Now, I’ll take guesses.

Audience: Slack.

Mamoon: I heard Slack. Other guesses? Hint, all three other company CEOs have been here or will be here today.

Mamoon: Box, I heard Box. All right. I think I heard Box, Slack and…

Audience: Yammer.

Mamoon: …Yammer. There we go. These are amazing companies. Amazing, amazing companies. They are Unicorns, they will be Decacorns. The point is that enterprise software companies are growing faster than ever. They’re growing at unprecedented rates. The universe for who you can sell your software to, has increased dramatically over the last five years. Everybody is adopting cloud software. The mom and pop is, the SMB is. the enterprise is. It used to be hundreds and thousands of enterprise software users, it’s millions, 10 millions. Now that the market size is so massive, you’re seeing companies growing this rapidly, which again, you should ask yourself: “Is my company growing this rapidly?” and, “How do I stand out in a crowd like this of overachievers?”

The next few slides, I’m going to talk about how you can stand out, and I’ll talk about some of the last few investments that we’ve made at Social+Capital in the enterprise space.

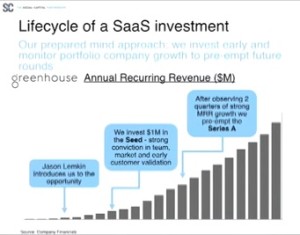

The first company is Greenhouse. You saw Daniel here, up on stage a couple of hours ago. It’s an HR recruiting software platform. We had spent a lot of time looking at the HR software space for the last several years, never really pulled the trigger. We heard a lot of our friends, a lot of portfolio companies, the entrepreneurs say, “Hey, you know, software in this general category sucks.”

At some point, we actually gave up on the category. Then, Jason, about two years ago, mentioned that we should meet with these guys from New York… Greenhouse. We did, and we actually sent them straight over to a couple of high growth companies that were actually having problems with their recruiting software. They very quickly validated, like, “This is exactly what we want to see. If it was more mature, we would buy it right now.”

We wrote an instant check of a million dollars in the seed round. That was about two years ago.

We saw growth happening a couple of quarters in… companies like Uber, Airbnb, Pinterest, AdoptIt, Greenhouse, and we’re like, “This is going.”

We actually pre-empted a Series A and decided to invest in Greenhouse and lead a round. That was about nine months ago. Since then, the company’s 3 X’d in revenue. It turned out pretty nicely, long ways to go.

The next company here is a company called Intercom. How many of you know Intercom? Raise your hand. Every SaaS entrepreneur should know about Intercom. It’s a great tool for every SaaS entrepreneur to use for their own product.

It’s a snippet of JavaScript… you add it to your site, and you can instantaneously start observing, supporting, engaging with your customers. Awesome tool. Exactly how I heard about it — it was through a bunch of entrepreneurs who were saying, “Hey, you know, let me pull up Intercom for you and show you the stats in there.”

I remember this one entrepreneur, Jesse Lamb from Dispatch. Jesse, are you here? If you’re no t, thanks for referring Intercom. I asked him, “Hey, can you introduce me to Owen at Intercom, the CEO?” He was like, “Yeah, absolutely.” Met Owen from Intercom, fell in love with him, fell in love with the product and the vision.

t, thanks for referring Intercom. I asked him, “Hey, can you introduce me to Owen at Intercom, the CEO?” He was like, “Yeah, absolutely.” Met Owen from Intercom, fell in love with him, fell in love with the product and the vision.

The notion that “A customer is a customer, is a customer” — that you have one customer record that you used for marketing, for selling to them, supporting them, to a customer success, made a lot of sense to me. This unified longitudinal view of a customer, made a ton of sense to me.

I’d invested in CRM companies, and marketing automation companies and customer success software companies, where they were siloed data sets and different applications had the same data all over again. Here, you’ve got a unified view. I love Intercom. We invested in the series A. The company is 20x since we’ve invested about 2 years ago. This is all about word of mouth — people talking about your product, and saying how much they love it.

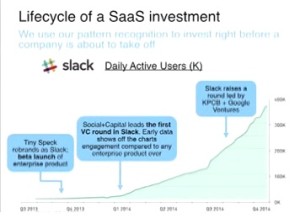

The next investment company that you guys I think all know is Slack. Here, the lessons learned from Yammer really helped. You saw the stats of conversion rates and the growth of Yammer. This has all that times 3 on both growth and conversion rates, and unheard of engagement and monetization.

It is the fastest SaaS business ever. We measured, right before this company took off, we were able to look at a months’ or two months’ worth of data and really make a judgment call on this early data to invest, because we had never seen metrics like these before.

Since the investment in Q1 of 2014, the company’s 10X’d on all metrics. These are examples of companies that we’ve invested in.

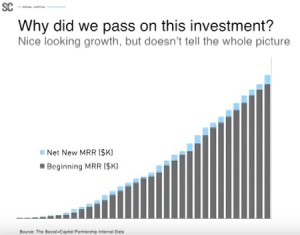

Here’s an example of one that we didn’t invest in.

Here, nice looking chart, but underneath the chart are really some issues. This shows that there’s crazy gross churn… a churn that is super high. This is a company that sells into S&Bs, where we expect churn to be way below three percent and, actually, ideally, close to two percent. It’s way high.

This actually doesn’t tell the complete story. Let me add net churn, which is the churn that includes expansion revenue. Even that’s not so great. We want it to be below zero. Here, it’s still mostly above zero.

How do we react? This is how we react. Run for the hills. But let’s just peel the onion back a little bit more. Look at the MRR and how it’s outpacing cancel MRR — barely though. What’s happening here is they’re selling, but then they’re also losing just as much.

Every single sale that’s being made is being negated by people who are unhappy with their product. This company has a product problem. Customers don’t either know how to use their product or they’re unhappy with their product. Actually, there are some people that actually do like the product and they’re expanding their use of the product.

The expansion is actually the only thing that is keeping this company afloat. Really important takeaways here and something that we really dwell on inside of our firm is this notion of above the line, net new MRR, and below the line net new MRR.

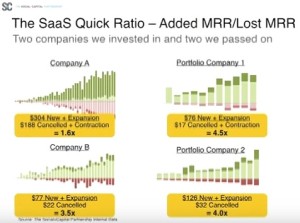

We’ve coined the term called the “quick ratio,” the SaaS Quick Ratio. It’s a derivative from accounting. It’s an accounting term, which measures assets and liabilities. We apply it to SaaS. It’s like, “What’s the MRR that’s added? It’s above the line. You divide the ARR that’s lost, or MRR that’s lost, that’s below line.” You just do a quick ratio.

Here are two examples of companies. The one on the left are two companies that we did not invest in , and to the right are two companies that we invested in. You do the quick math, and this is what it looks like.

, and to the right are two companies that we invested in. You do the quick math, and this is what it looks like.

Companies on the right, four or above. Companies on the left, less than four. Simple: pass, invest. It’s not always that simple. But we try to use data as much as we can to make good decisions. Here’s a way of making some good decisions. We still don’t know though.

What’s the recap? What’s the good and the bad here? You want to try to get product market fit. Get to one million ARR. If you’re a super early stage startup, you want to see your MRR grow quarter over quarter. If you don’t grow month over month, it’s not the end of the world, but if your MRR is declining quarter over quarter, it means that you’re not presumably getting better at selling. You’re not getting word of mouth. You’re not getting raving customers. A lot of the companies that we have invested in grew to that one million, that two and three million, five million purely on word of mouth and no sales or marketing.

That’s super important — to have efficiency early on. Get the product market fit right. It’s really good hygiene. Then that quick ratio thing, maintain a quick ratio of greater than four, aspirational.

What to watch out for? That low quick ratio, churn being too high, and new sales that are not working. Net new MRR declining is terrible. Again, it’s like you need to go back to the drawing board and see what’s going on with your sales or your product, because something is off there. Because of all this, maybe you’re just not growing fast enough to get to that $1 million of ARR.

Here, very high level takeaways. There’s a lot more to it. But if you can think about some of these things and use it as a framework, I think it would be helpful to all of you.

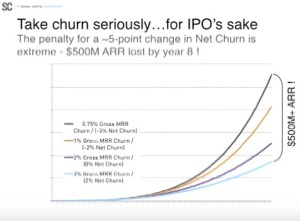

Let me sum it all up, and look at a company that’s eight years out. The line on the top is a beautiful hockey stick line with a really nice gross churn and really nice negative churn, which I think is achievable for companies.

The bottom line, the blue line is one where it’s high gross churn and not so great negative churn, or net churn.  It’s a $500 million difference over a period of eight years. If there’s one takeaway from the Box IPO roadshow I just saw in part is that if Box stops selling today to new customers and focused on growing their existing customer base, they will be a billion dollar business in 2020.

It’s a $500 million difference over a period of eight years. If there’s one takeaway from the Box IPO roadshow I just saw in part is that if Box stops selling today to new customers and focused on growing their existing customer base, they will be a billion dollar business in 2020.

I think Aaron maybe even talked about it earlier today, is how do you sell better to existing customers? The customers may already be happy. How do you keep them happy and grow in the typical Land and Expand model, which is so beautiful in SaaS?

If there’s one thing I want you to take away from this presentation…

Mamoon: Don’t churn and burn. Thank you very much. Please if you have any questions email me or Andy, one of my colleagues who helped me put together this presentation. Are we good?

Jason: Yeah, awesome.

Mallun: Mamoon, thank you very much. Thank you, Jason.

Transcription by CastingWords