Britain’s housing crisis can only be solved if the government switches to a capital gains tax on homes, according to a report. The National Institute of Economic and Social Research (Niesr) warned that prices would continue to rocket, pricing first-time buyers out of the market, while property was lightly taxed compared with other assets that investors can buy.

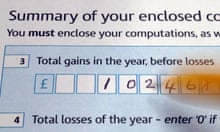

Buyers need to find a deposit of £80,000 to afford an average home, after a 50% rise in prices over the past decade.

The thinktank also urged ministers to end their reliance on private sector housebuilders, which it said could never meet the demands for affordable homes to rent or buy.

The hard-hitting report will sting George Osborne, who has said his reforms of stamp duty on property transactions would cool the market and reduce speculation from buy-to-let landlords. The chancellor’s higher charges on the purchase of expensive homes have affected sales of properties worth more than £5m, but have so far done little to deter buy-to-let investors from outbidding first-time buyers.

Angus Armstrong, a senior economist at Niesr, said damaging trends in the property market needed to be tackled to prevent it from undermining the UK’s sustainable growth. Booms and busts in the UK housing market are the worst in the developed world, according to the Organisation for Economic Co-operation and Development. The worst trends highlighted in the report were:

- More houses being bought for investment purposes, raising the cost of housing

- The older generation “underoccupying” and even “hoarding” property

- The number of new homes being built being lower than the number of new families

- The reclassification of housing association property as part of the public sector, making it harder for social landlords to access long-term, stable funding

“A first priority must be to improve the taxation of housing. An efficient tax system would be consistent across assets and leave the decision about how much to consume today versus save and consume tomorrow unaffected,” Armstrong said. “If a capital gains tax were introduced, this would reduce the gains in an upturn and losses in a downturn, so dampening house price cycles. These ideas are unfortunately in the opposite direction to recent policies.”

A growing number of economists have argued for an annual tax on land and property to end what many have called the UK’s addiction to property speculation. The boom in buy- to-let since the late 1990s, when banks relaxed their criteria for offering commercial mortgage loans, has also fuelled speculation by investors.

House prices have increased by a total of 50% in the last 10 years, despite a 20% fall following the 2008 banking crash. The value of households’ and non-profit institutions’ dwellings was £4.43tn in 2014 – 58% of the entire net wealth of the UK.

With the rise in value and number of buy-to-let properties, estate agent Savills have estimated, landlords with mortgages now have more housing market equity than owner-occupiers with mortgages.

Armstrong said rising property prices meant that the UK was suffering a period of intergenerational unfairness, largely driven by the hoarding of bigger homes by older households. “The 50% rise in house prices over the past decade benefits the existing owners at the cost of those wanting to become owners,” he said. “The younger generation, perhaps simply not old enough to own in 2004, now have to save 50% more from after-tax income just to afford an average UK home.”

Comments (…)

Sign in or create your Guardian account to join the discussion