Ottawa’s new rules showing ‘no impact’ on hot Vancouver, Toronto housing markets

Analysis: The two strongest housing markets in the country, both targeted this year by new housing policy from Ottawa, continue to exhibit no sign of slowing down at all

Article content

TORONTO • The two strongest housing markets in the country, both targeted this year by new housing policy from Ottawa, continue to exhibit no sign of slowing down at all.

On Monday, the Real Estate Board of Greater Vancouver said March was the highest selling month on record.

Tuesday it was Toronto’s turn. Canada’s largest city showed it’s on pace to make 2016 a record-breaking year for existing home sales as prices continue to punch through new highs.

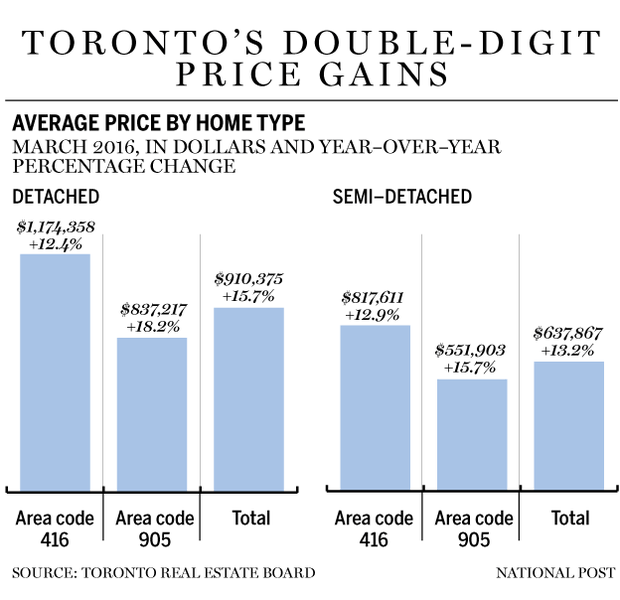

More than $7.1 billion in resale housing activity was conducted in the Greater Toronto Area in March, as 10,326 homes changed hands — a 16.2 per cent increase from a year ago. Coveted detached homes in the city of Toronto sold for on average $1.17 million, up 12.4 per cent from a year ago.

Toronto prices still remain no match for Vancouver, where the average price in March for a detached home in the region was $1.78 million. Metro Vancouver set a record for sales in month in March as the board’s index for all housing prices was up 23.2 per cent from a year ago.

“The interesting thing to me in the Toronto data is how little impact the modest tightening measures by Ottawa have had on the hottest market, i.e. no impact. They must try harder,” Doug Porter, chief economist with the Bank of Montreal, said in an email. “Toronto increasingly looks like a milder version of Vancouver. Now some of strength may be due to relatively favourable weather, but the big picture is that these two markets quite simply remain too hot for comfort. I am increasingly concerned about the mounting anecdotal stories of speculative activity and the rampant bidding wars through much of the GTA (no longer just the city of Toronto).”

Ottawa created new mortgage rules that took effect Feb. 15, increasing the minimum down payment to 10 per cent from five per cent for the portion of a home valued over $500,000. The move was generally seen as aimed at the Toronto and Vancouver markets where prices easily top $500,000.

Mark McLean, the president of the Toronto Real Estate Board, said the numbers for the first quarter of the year suggest Toronto sales will hit a record in 2016; TREB’s own consumer surveys point to “robust” buying intentions entering the height of the spring market. The 22,575 sales in the first quarter across the GTA were up 15.8 per cent compared to the same period a year earlier.

Jason Mercer, director of market analysis for TREB, said only the short supply of new listings held the Toronto market back. “We could have experienced even stronger sales growth were it not for the constrained supply of listings, especially in the low-rise market segments,” he said.

Peter Norman, the chief economist with Altus Group, said Toronto will begin to slow down once some of the new suburban housing developments are approved. “I think it will resolve itself in the next couple of years,” said Norman. “The pressure valve will come off. On the Vancouver side, there is strong demand and the development industry is struggling to bring forward new supply. It is a market that should stay pretty strong until we see the pendulum swing away from Vancouver in terms of economic growth.”

Statistics were also released Tuesday from Canada Mortgage and Housing Corp. with a focus on the condominium markets in Toronto and Vancouver — both of which the Crown corporation called stable.

CMHC interviewed 42,681 households in Toronto and Vancouver, focusing on domestic households and not foreign investors. It found 23.5 per cent of the condominium market is investors and a majority of those people are in it as long-term investments — 59.8 per cent planning to hold for five years or more, while 48.6 per cent of investors bought their property for rental income.

“The big takeaway from this is the stability,” said Dana Senagama, who does market analysis for CMHC. “This is the third year in a row we have done this and these numbers haven’t changed much. That’s encouraging with all the naysayers.”

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.