Q I live with my wife in a flat in central Glasgow and we’re looking to move somewhere quieter with more space.

The market conditions for our flat appear to be more favourable for renting than buying – some flats take ages to sell, but are very popular with renters. Perhaps because it’s in an area popular with students and young professionals. We’re therefore considering letting out the flat and buying a new house. The flat is worth somewhere between £170,000 and £180,000 and I have a mortgage with around £100,000 of outstanding debt. Other flats in our block are let for about £850 per month. Both the existing and new properties are in Scotland – does the proposed 3% stamp duty land tax for second properties apply in Scotland? If so, and we kept our flat, would this apply to our new house even though we’d be living in it? We would need to get a buy-to-let mortgage on the flat – the existing mortgage is in my name only. Could this be taken out by my wife and the rental income paid to her? If yes, would this make sense given that she earns less than me (we both earn below the higher-rate tax bracket)? I have some separate savings for a deposit for the new house, but are there any options for using some of the equity in the existing flat towards a deposit for the new house? LS

A The new higher rates of stamp duty land tax (SDLT) do not apply in Scotland because SDLT has been abolished there. However, the Scottish government replaced SDLT with land and buildings transaction tax (LBTT). This is remarkably similar to SDLT and will introduce a 3% supplement on the tax paid on the purchase of additional residential properties on or after 1 April 2016.

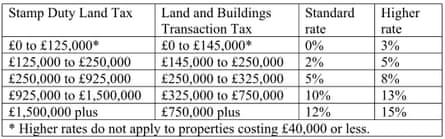

As in the rest of the UK, unless an additional property costs less than £40,000, the higher rates will be payable. However, where LBTT differs from SDLT is in the rates of the tax. The table below shows both the standard and higher rates in both Scotland and the UK, with Scotland having a slightly higher starting band before LBTT kicks in.

Although the rates are different in Scotland, the rules when applying the higher rates are likely to be the same as for SDLT. According to the consultation document Higher rates of Stamp Duty Land Tax (SDLT) on purchases of additional residential properties, recently published by HM Treasury, this will mean that if at the end of the day when you buy an additional property you own two residential properties, the higher rates of both SDLT and LBTT will apply. So if you kept your flat to rent out and bought a new house to live in, you would have to pay the higher rate of LBTT (or SDLT in the rest of the UK) on the price of the new house. But if you were to sell the flat within 18 months of buying the house, you would be entitled to a refund of the extra 3% paid.

As far as putting the buy-to-let mortgage in your wife’s name, it’s possible but whether you can actually do it depends on lending criteria. As to whether it makes sense to have all the rental income paid to your wife, it would have to be if the mortgage was in her sole name. It wouldn’t make sense if the rental income pushed her over the higher-rate tax bracket. It could make more sense to take out a joint buy-to-let mortgage so that the income is split equally between you.

Finally, in theory, it would also be possible to increase the amount of the mortgage on the flat to raise cash to put towards the purchase of the house. But the buy-to-let mortgage would not be able to be more than 75%-80% of the value of the flat, and the rental income would have to cover the mortgage payments by at least 125%.