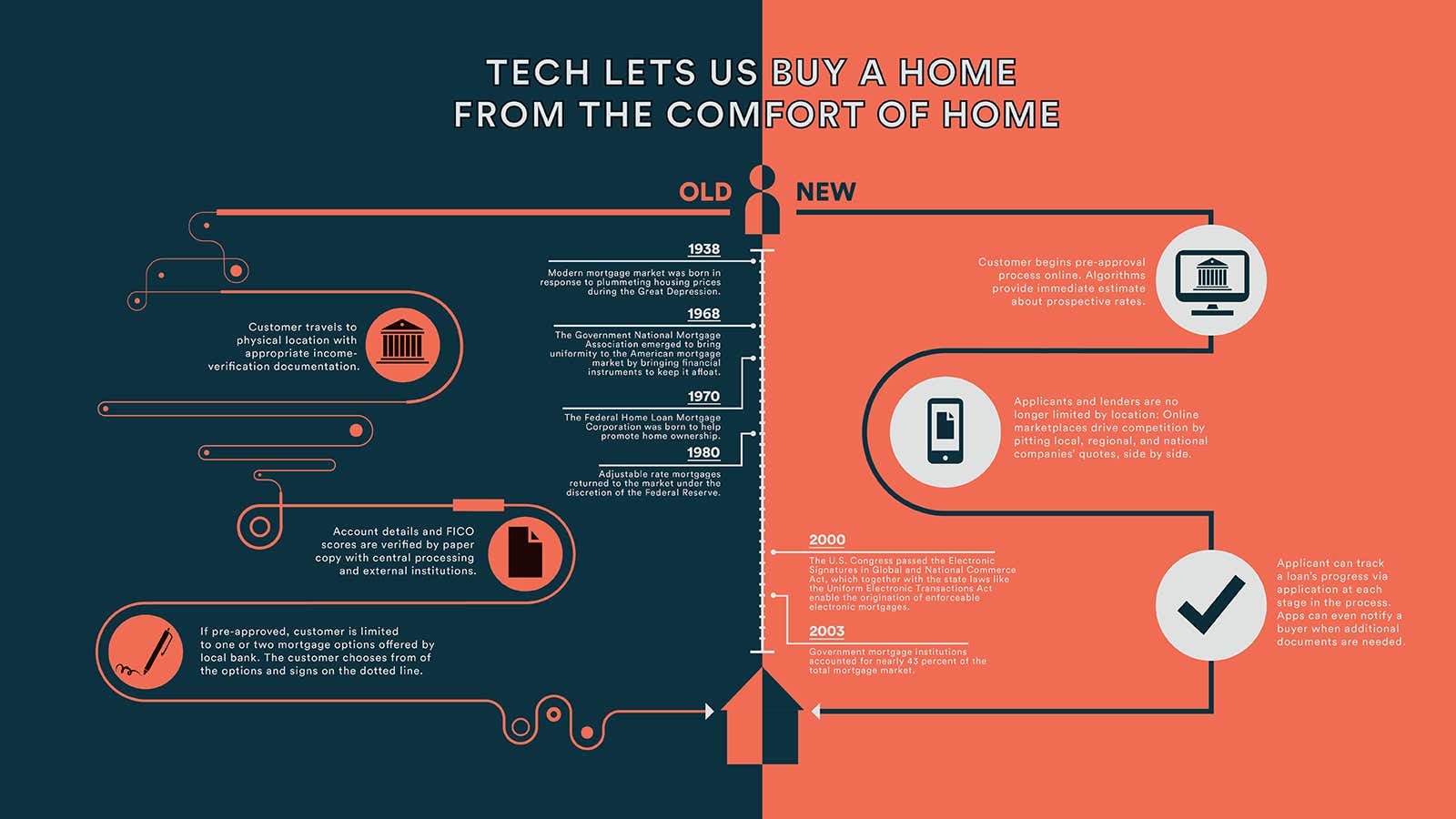

(See the infographic enlarged.)

Technology trends like the cloud, Big Data, and mobility are changing the mortgage industry, making it more efficient and better suited to the needs of buyers today. Millennials are now the largest group of recent homebuyers and their share of the market will only grow. And online marketplaces have expanded consumer choices, allowing mortgage companies to tailor financing to individual consumers’ needs.

In the past, prospective mortgage applicants underwent a cumbersome approval process that included printing out hard copies of the required documents and traveling to a brick-and-mortar location. Today, as banks shift from a costly paper-based process to one that is fully digitized, customers can proceed through the pre-approval process in mere minutes, with no more effort than a few choice clicks and taps. Eighty-nine percent of homebuyers now use some form of technology to help with the homebuying process, and 93% confirm that technology is eliminating steps they otherwise would have had to do in person.

Peruse the infographic above, which depicts the ways in which cloud-based services have streamlined the process of financing a home, contrasted against the onerous application process of a generation ago.

Read more from HPE Matter’s Next Enterprise issue here.

This article was produced on behalf of HPE Matter by the Quartz marketing team and not by the Quartz editorial staff.