Neo: If you’re killed in the matrix, you die here? (The Matrix, 1999)

We often make a distinction between the virtual and the real world. We will ask whether something happened online or “actually happened”, as if the online world were a parallel universe in which actions have no impact on our current lives. But the truth could not be further from that. Most of the things we do online can impact our “real”, palpable lives. Our perception and our laws may not have caught up to this fact yet, but reality has. We buy things virtually, we are part of communities that need no physical space to assemble and there are probably married couples out there who have met online.

How the Stock Market Works

One of the biggest impact the Internet can have on the real world is actually on something that is still more virtual than real: the stock market and stock trading. To better understand this impact, you first need to know, at least at a very basic level, how stock trading works. Companies make their stocks (or shares) available for the public to buy and sell by getting listed on the stock exchange. Traders act, for the most part, like rational economic actors and try to maximize profits by buying stocks which have a high probability of increasing their value (for instance if a company is about to launch a follow-up to a successful product) and selling stocks which have a high probability of decreasing value (for instance if a company is about to face a lot of new competition).

One of the funny things about the stock market is that every time one person buys, another sells, and both think they are astute.

We say that actors are rational “for the most part” because this whole ordeal is largely based on predictions and predictions can be influenced by a variety factors. Aside from the economic factors, decisions to buy or sell can also be influenced by political factors (if the laws in a certain country are about to change or a period of political instability is about to come up), social factors (if a strong social for or against reaction against a certain environmental trend is on the rise), technological factors (if scientists are on the verge of a discovery that might create the market for a new series of products) and so on.

Stock Market – The Place Where Economic Perception Is Reality

More importantly though, decisions can also be shaped by perceptions. On December 3, 2004, a member of a social activism group called The Yes Men, appeared on BBC. Only that he didn’t appear as himself, but rather pretended to be the spokesperson for Dow Chemical, the second-largest chemical manufacturer in the world. Andy Bichlbaum, half of the Yes Men, talked about the Bhopal disaster, one of the worst chemical disasters in history, which happened at one of Dow’s factories in India during the 80s. As a company spokesperson, Andy apologized on behalf of Dow and vowed to make amends to the community to the tune of $12 billion in reparations. Within less than half an hour from this BBC appearance, Dow’s market share price fell 4.24%, wiping $2 billion off its market value.

So here is something that never actually happened, but only appeared to have happened, creating a real-life effect – and quite a major one for that matter. It was the Yes Men still who within hours of Andy’s appearance on the BBC issued a disclaimer about the hoax. There is no telling how much more Dow’s stocks could have plummeted if they had not issued the clarification. Because to the world at large, helped in no small part by the use of BBC as the channel, the message was true. The lesson here is that the stock market is a very volatile phenomenon and it should not be surprising that it can be influenced by “virtual” events.

It should come as no surprise then that one of the events with the biggest impacts in the online world could also influence stock prices for some companies. And here we would like to have a closer look at Google’s algorithm updates. Considering the world of difference a Google ranking makes, is it plausible that the effects of an algorithm change ripple beyond the results page? There are 2 actors to consider here: Google itself and the companies that are ranked by Google’s search engine.

Can Google Updates Sink the Stock Market?

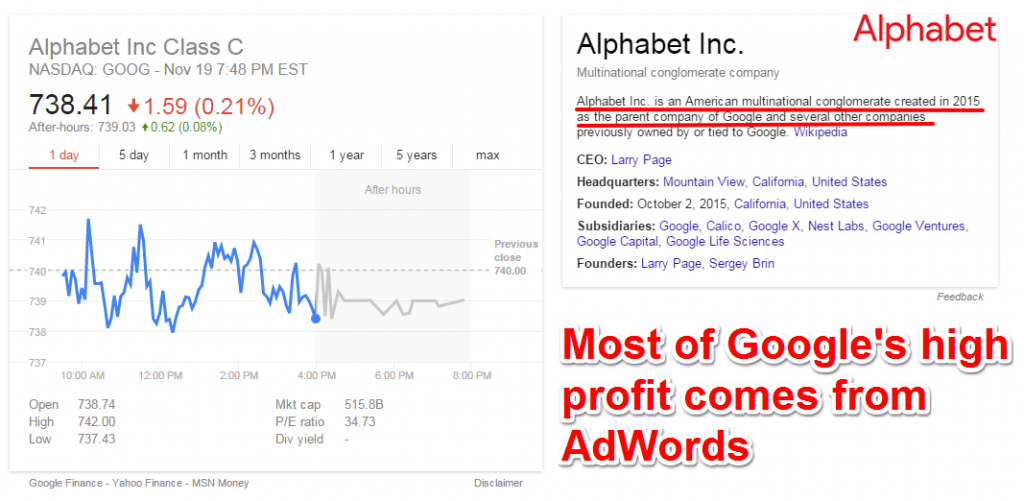

For Google, there does seem to be a correlation between major algorithm updates (such as Panda or Penguin) and slight increases in stock value. Since the increases happened shortly after the updates, there is also a possibility of a coincidence, given that at that point there would have been no way of accurately estimating the impact on company profits. At the same time, it is worth remembering what we mentioned earlier: not all decisions in the stock market are based on tested results; some are based on the potential of winnings. If tech-savvy traders sensed that there might be some significant positive changes in the Google revenues following the updates, a hunch would have been enough to get them more interested in Google stocks. Because Google relies on AdWords to make its profits, it would make sense that when the algorithm changes, more people become interested in getting AdWords to stay ahead of the curve. The specter of uncertainty makes people more prone to invest in things that will safeguard them from the unknown.

The flipside of the coin is that companies using Google to promote their business are also affected by the algorithm updates, but in a more direct way. Depending on the updates, companies may win or lose online visibility.

Some companies lost as much as 75% of their visibility, while others gained as much as 500% . But is this enough to create a stock market effect?

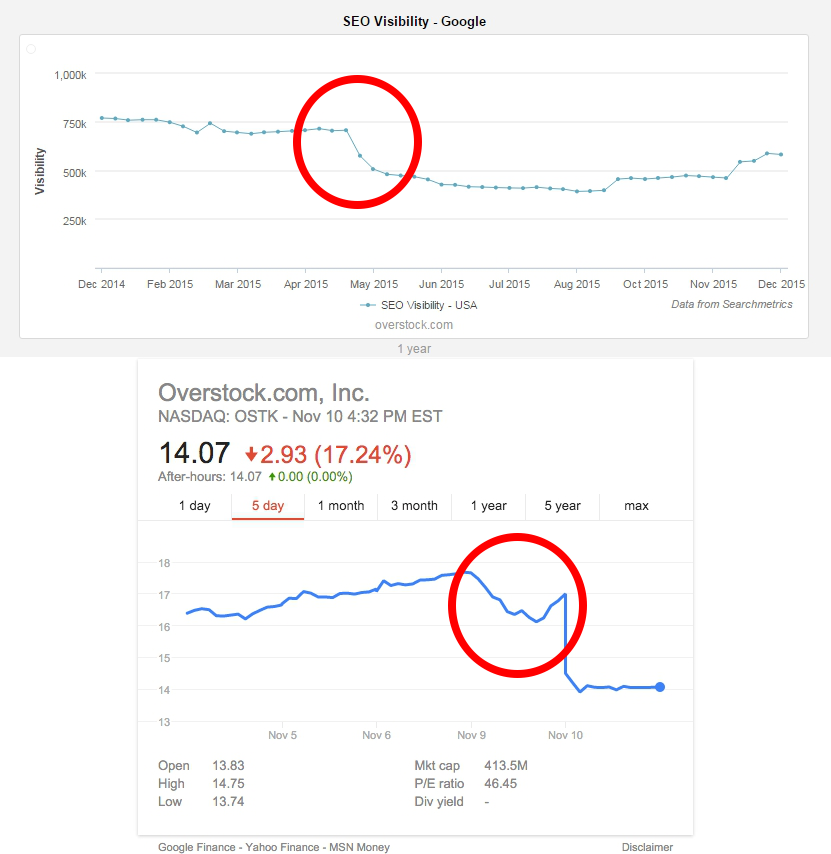

Quite possibly, since perception is as good as reality when it comes to stock trading. One example where this seems very likely is Overstock, whose shares dropped steeply right after a Google update. A 33% decline in search visibility in May 2015 is correlated with a subsequent 11% drop in earnings and a 17% drop in stock price, as seen in the image below.

Patrick Byrne, Overstock’s CEO, in a press release announcing the company’s results for the third semester of this year, declared that the loss they were facing was due to some Google’s changes.

“We are experiencing some slowing of our overall revenue growth which we believe is due in part to changes that Google made in its natural search engine algorithms, to which we are responding.

(…)

Third of the problem was the Google search change, as it affects everybody. It affected – it was a little bit different this year than it was in previous years in some respects in who’d help and who’d hurt. But we think we’ve already learned our way out of that.”

Then again, correlation does not prove causation and it is quite obvious companies have an incentive (or at the very least a bias) to find explanations for such drops in external factors.

Penalties – Stock Market Correlation Examples

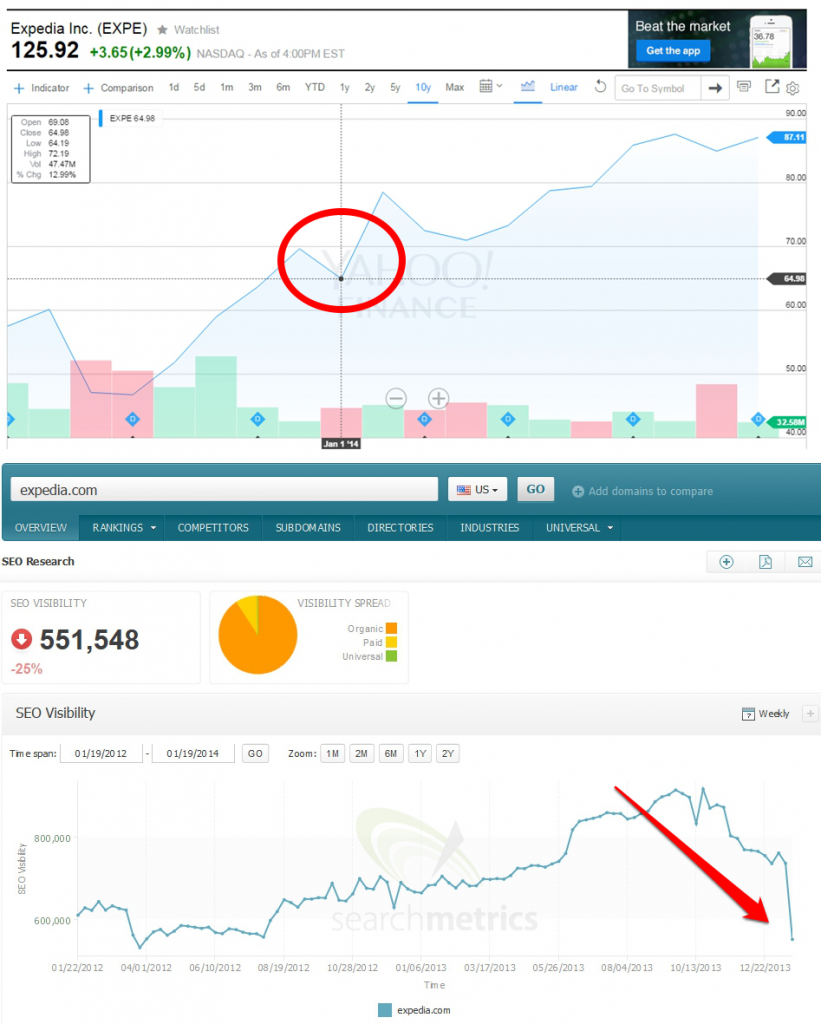

Still, the correlations cannot be denied and the very least they keep the discussion going. Expedia’s penalty was a quite controversial subject around two years ago. Whether the big travel company was penalized due to unnatural links or it was the case of a negative attack (both hypotheses were brought into discussion) on thing is sure: they had a massive drop around January 2014. As you can see from the screenshot below, the drop is quite dramatic and the major travel website,

Expedia, seems to have lost 25% of their search visibility in Google, according to Searchmetrics.

Moreover, the drop was not visible just in the search engine but also in Expedia’s stocks, coincidence or not, exactly in the same period of time.

Same thing happened to eBay which was hit by a manual penalty caused be Panda 4.0 update somewhere in the spring of 2014.

A similar drop was reflected in eBay’s shares as well.

As mentioned above, correlation does not prove causation and usually companies find explanations for drops in external factors.

JC Penney was penalized in February 2011 because they were suspected of buying links to rank better in Google.

Many of their pages got degraded from ranking in the first page of Google (for 90 days) and if you look at stock prices for that time frame you can see an ever so slight slump between February and March.

At the same time, there are other examples which seem to stray from the narrative, such as BMW.

In February 2006 the company was accused of using cloaking and the entire site was removed for 3 days.

However, this does not reflect in any way in the stock market prices from around that time, which seem largely unaffected in February and increase steeply in March.

There are, of course, explanations and interpretations which might also support the theory so far. For instance, it is entirely possible that penalties were, in fact, applied earlier, and the beginning of February only marks the time Matt Cutts acknowledged welcoming BMW back on the web. This would definitely fit in with the chart. There are also other possible, not-web-related events that may have happened in the spring of 2006 that could account for the spike increase in February.

Conclusion

The thesis here is not necessarily that online (or, more generally, “virtual”) events supersede the real ones, rather that they have a direct, quantifiable impact on them and that what is “real” and what is “virtual” is often subject to change and there is no real dichotomy here.Yet, even if we cannot do anything more than assuming, there is still an interesting theme to debate, whether there is indeed a strong correlation between stock market trends and Google updates.

Site Explorer

Site Explorer Keyword tool

Keyword tool Google Algorithm Changes

Google Algorithm Changes

Leave a Reply!