As reports of a draft deal between the EU and the UK helped out the pound, the In/Out referendum is getting closer. Here is the view of Goldman Sachs on a potential impact of a “Brexit”:

Here is their view, courtesy of eFXnews:

Our base case forecasts for Sterling do not envisage that the UK will leave the EU. However, given the market attention on the possibility of a ‘Brexit’, it is worth asking what the potential impact on the GBP would be should the UK vote to leave.

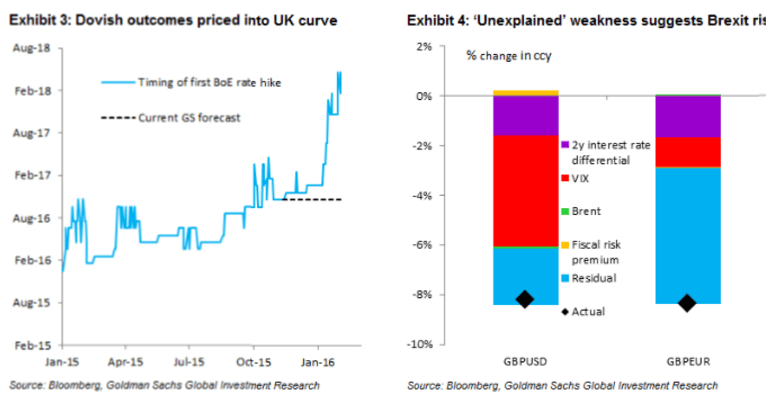

What sort of downside for Sterling could be expected should the UK vote to leave the EU and capital inflows slow? The number of moving parts in such a discussion precludes any definitive answer, but we can estimate the potential magnitude of a move. One way to do this is to assume that a ‘Brexit’ decision causes an interruption to capital flows into the UK that forces a sharp closure of the current account deficit, admittedly a strong assumption. To do this, we revisit our ‘FEER’ (fundamental equilibrium exchange rate) framework for the UK economy, first introduced here, which estimates the relationship between movements in the currency, domestic demand and the current account.

Using this model, we can ask what degree of depreciation of the Pound would be required to close the deficit. When we impose a full closure of the current account via the exchange rate (rather than domestic demand) from the latest available level of 3.7% of GDP, our rough estimates would imply a drop in the trade-weighted GBP of 15-20%. If the move was uniform across currency pairs, this would take GBP/USD to around 1.15-1.20 and EUR/GBP to around 0.90-0.95. This could be smaller if there was a larger adjustment in UK domestic demand. But, in our framework, a decline of 2% in domestic demand would still see close to a 15% drop in the GBP to close the current account deficit.

Ultimately, our forecasts are based on a view that the UK will remain in the EU and that, as a result, the underlying dynamics will remain solid in the UK economy. We expect that the erosion of economic slack – particularly in the labour market – will eventually drive a tightening cycle faster than the market is currently discounting. Against a ECB with plenty of work to do to support inflation, this should see GBP re-visit recent lows in EUR/GBP over the next year. We continue to forecast EUR/GBP at 0.68 and GBP/USD at 1.40 in 12 months.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.