Stocks are stuck in a funk. The NYSE Composite Index is braced against overhead resistance going all the way back to July. But specific areas of the market are rising with a sweet lightness that reminds us that while the economy may be struggling in certain areas — like shale oil communities, for instance — there are other areas that are prospering and growing. Homebuilders are one such area.

The iShares Dow Jones U.S. Home Construction ETF (ITB) recently notched a new 7.5-year high as sentiment on the housing sector warms along with the arrival of spring. This new upward excursion for the industry group breaks a funk going back to 2013, which coincides with a slowdown in the pace of home price gains according to the S&P/Case-Shiller Home Price Index.

Related: Car Sales Are on Pace to Do Something They Haven’t in 50 Years

Although housing starts have been soft (after all, it's hard to build when there's snow on the ground) housing sales (both new and existing) have recently rebounded to the surprise of many. New homes sales surged 7.8 percent on a monthly basis in February to a seven-year high. Existing sales jumped 1.2 percent on a monthly basis.

Demand must indeed be strong if buyers are willing to trudge through the ice and slush to attend open houses and make offers.

As a result of the increase in demand, and the stagnation of supply, the inventory of homes for sale is tightening again — which will be a boon both to home prices (which, when they rise, should attract new buyers) and homebuilders. At the current sales rate, for the first time since 2013 there are less than five months of supply on the market.

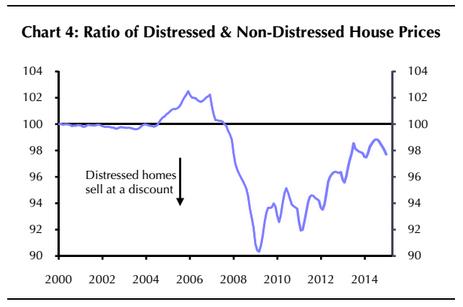

Moreover, the glut of distressed, foreclosed or short-sale inventory at discounted prices coming out of the housing bust has been greatly reduced. This will remove a big source of downward pressure on home prices as the cheap deals that kept a lid on the price appreciation of nice properties have largely disappeared. You can see that in the chart above.

Another dynamic at work is that millennials and other young adults — many of whom are college educated but saddled by debts — are preparing to bust out of mom and dad's basement, according to new research by UBS.

Related: ‘Irresponsible’ Millennials Saving More Than Almost Every Other Group

The household formation rate, after disappointing for much of last year, is bumping up. Survey results show a majority currently living with relatives and friends are now looking to rent or buy their own place within the next 12 months. Specifically, 55 percent of respondents are planning to get their own place vs. 44 percent back in November.

There also seems to be a budding acknowledgement that the market is tightening: 58 percent believe it will be somewhat to very difficult to find the property they want to buy vs. 43 percent in November.

Michael Dahl at Credit Suisse recently wrote in a note to clients that his monthly survey of real estate agents revealed that buyer traffic increased in March to its best level since the summer of 2013 and is up by nearly one-fourth since last year. Agents are reporting that buyers are perking up thanks to a more favorable mortgage rate environment and government initiatives (including reduced down payments and lower FHA premiums). A sense of urgency is being fueled by lower inventory levels and fears of higher future costs.

Mortgage lenders are also looking for a turn in activity, according to Thomson Reuters data. In the first quarter, 70 percent of mortgage lenders are reportedly expecting stronger loan demand over the next three months. This is up from a lull of around 20 percent in this measure in the third and fourth quarters of last year.

Related: The 25 Most Expensive Cities For Renters

Adding color to the thesis that the housing market could be on the cusp of a turnaround were comments from Hovanian (HOV) management in mid-March that it's preparing for a breakout year in 2016 with much higher profitability. KB Home (KBH) management expects a strong second half of the year featuring accelerated revenue and earnings growth. It cited a jump in traffic, improving housing fundamentals and solid demand at the start of the spring selling season.

How much improvement should we expect?

Ed Stansfield at Capital Economics is looking for home price inflation to increase from 4.7 percent in 2014 to around 6.5 percent this year and 4 percent next year. This is well ahead of the consensus estimate of 4.5 percent for 2015.

If the Federal Reserve drags its feet on raising interest rates — possibly even postponing rate liftoff until 2016 amid a recent slowdown in job growth and below-target inflation rates — there could be even more upside as mortgage rates stay down and boost affordability. In this scenario, Stansfield envisions mortgages rates hovering near 4 percent at the end of next year instead of 4.75 percent in his base case. That could, in turn, help push the unemployment rate below 4 percent and lift wages in a big way.

Related: Bernanke Was Right — Interest Rates Aren't Going Anywhere

Cheap credit and higher wages will boost purchasing power, lifting home prices more aggressively: Stansfield sees year-over-year price gains of 8 percent in 2015 and 2016 under this outlook.

Here's the kicker: Should this happen, home prices nationwide would set new record highs sometime in early 2016, finally clawing back the losses suffered in the housing bust. No wonder housing stocks are on the move.

Top Reads from The Fiscal Times: