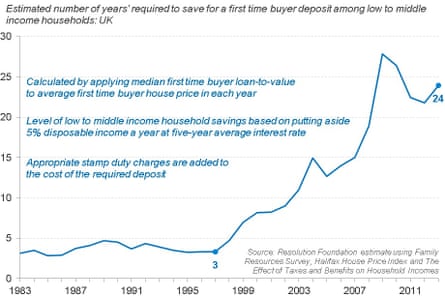

Homebuyers now have to save for up to 24 years to set aside a deposit large enough to buy them a foot on Britain’s housing ladder, according to new research.

The Resolution Foundation thinktank has used the Bank of England’s latest survey of household finances to show that with house prices rising sharply, it would now take almost a quarter of a century for low- and middle-income households to accumulate a deposit on average, if they set aside 5% of their disposable income each year.

It is lower than the peak reached before the financial crisis, but dramatically higher than the three years that was the norm in the 1980s and 1990s – and comes despite interest rates remaining at the emergency level of 0.5% set by the Bank of England in the depths of recession.

George Osborne has introduced a series of help-to-buy policies, including shared ownership schemes and taxpayer guarantees for mortgages for first-time buyers, and pledged in his spending review last month to “turn generation rent into generation buy”.

But Resolution’s chief economist, Matt Whittaker, warned that help to buy may simply boost house prices, lifting them further out of the reach of lower-income households.

“To the extent that these schemes have stoked demand and so propped up house prices in recent years, they have served to make homeownership even less attainable for many, while increasing the gains flowing to older homeowners who have been the main beneficiaries of the sustained housing boom,” he said.

Resolution said it is concerned that the rising cost of homeownership is exacerbating a generational divide, which has seen the baby boomer generation accumulate a financial cushion, while younger workers have struggled as wages have been squeezed.

Its analysis of the Bank’s data shows that among households headed by under-45s, 28% of non-homeowners say they do not think they will ever manage to buy. Among the poorest fifth of households, the figure rises to 39%.

Ashley Seager, co-founder of the Intergenerational Foundation thinktank, which campaigns for a better deal for younger households, said: “Today’s wealthy baby boomers found it easy to buy housing a generation or two ago, especially as MIRAS tax relief on mortgages was available to them. But now their children and grandchildren cannot access housing in anything like the same way.”

He welcomed the chancellor’s recent crackdown on the buy-to-let market, which has restricted the tax relief landlords can claim, with the aim of levelling the playing field with owner-occupiers.

The Bank of England’s financial policy committee, which has been given the task of preventing future financial crises, has also warned that it is becoming increasingly concerned about whether buy-to-let borrowers are fuelling an unsustainable boom.

Osborne is currently consulting about whether to hand the FPC new powers over buy to let, which could see the supply of mortgages dry up, even if the Bank’s base rate remains at zero.

Comments (…)

Sign in or create your Guardian account to join the discussion