How do you navigate the numerous sources of investment advice? How do you determine who is telling the truth and who is not? The answers to these important questions are key to successful investing.

Who Is Telling the Truth?

With market pundits on every news outlet and “experts” around every corner, the information they are selling may not always be what it may seem. How do you avoid falling prey to Wall Street analysts’ ulterior motives?

To be sure you have access to advice you can trust, you need a reliable source of truly independent research.

What Is A Safe Investment?

A safe investment is one that provides low risk and high potential reward or good risk/reward. One can measure risk/reward objectively if you have all the right data, especially data from footnotes. We believe the core elements of measuring risk reward are:

- Economic earnings

- Valuation – based on cash flow/economic earnings

The calculations require sophisticated models and a lot of data, some of which can be hard to get. But, that’s what it takes to be a smart investor.

Our recent report on General Motors (GM) was built upon these metrics. General Motors generates positive economic earnings, a top quintile ROIC of 15%, and has a low price to economic book value (PEBV) ratio of 0.6. This ratio implies that the market expects General Motors’ profits to permanently decline by 40%, in spite of the business operations showing otherwise. General Motors represents an excellent safe harbor investment.

Why Do You Need Safe Harbor Investments?

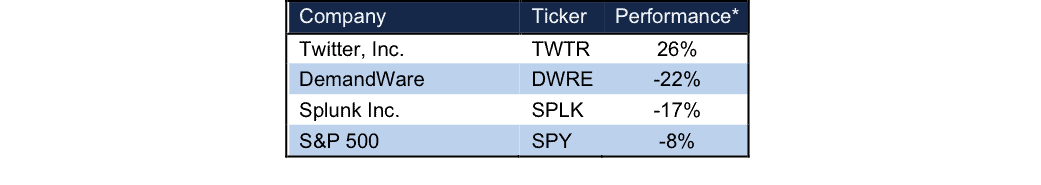

As we have seen recently, the seven-year bull market is growing weak. As this has occurred, stocks with lofty valuations have been reeled back in, often in dramatic fashion. Without focusing on the metrics above, investors are leaving themselves open to significant risk. Figure 1 shows the performance of three companies we’ve put in the Danger Zone recently, Twitter (TWTR), DemandWare (DWRE), and Splunk (SPLK). Each of these companies, despite low quality earnings, low ROIC’s, and extremely high valuations, had seen their share prices soar up until the market realized its error and shares crashed.

Figure 1: New Constructs Helps Avoid Dangerous Investments

* Closing prices from June 11, 2015 to September 24, 2015

Sources: New Constructs, LLC

How To Find Safe Stocks

Watch our recent webinar ” How To Find Safe Harbors In Market Storms”. In this webinar, CEO David Trainer, discusses the state of the market, what makes a safe investment, and how you can find safe stocks.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Photo Credit: Kamil Porembinski (Flickr)