The retail king has lost its crown.

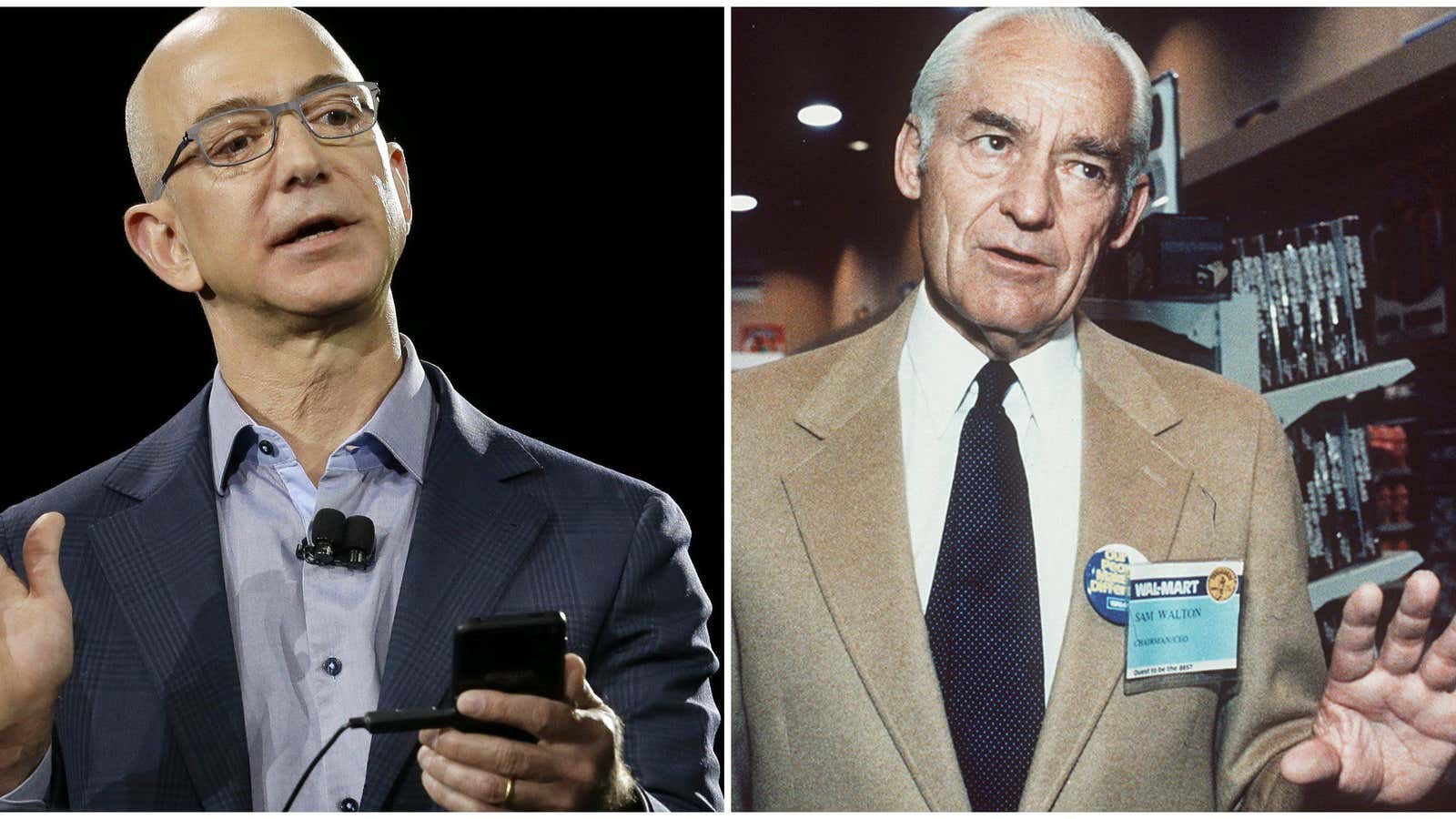

Amazon.com’s market value whizzed past that of Walmart in after-hours trading Thursday, as investors increased their bets that the future of the US retail sector will be dominated by Jeff Bezos’ online behemoth.

There’s no guarantee Amazon’s market value will stay above that of Walmart. During the thinly traded after-hours session, Amazon’s stock price leapt by over 14% to more than $550 a share after the company reported strong quarterly earnings results. That added more than $30 billion to Amazon’s market value, pushing it above $250 billion. (Walmart’s market value ended the day’s trading a bit above $230 billion, with little movement in the after-hours trading session.) Here’s a look at the long saga of Amazon and Walmart, taking today’s share surge into account.

The changing of the guard reflects the growing consensus that online retailing will play an increasingly central role in the global economy over the coming decades and underscores the high premium investors are placing on the growth they expect Amazon to deliver.

Online retailing currently accounts for only 7% of US retail sales. (Though online sales dominate some sectors such as books, electronics, toys, and baby supplies.)

That suggests there’s plenty of room for growth. It’s those expectations that have supercharged Amazon shares in recent years.

Instead of letting its revenue fall to the bottom line, Amazon keeps reinvesting back into the company. That’s a recipe for scant profits, compared to solid profitability from Walmart, even when the brick and mortar retailer’s quarterly sales slowed.

It’s worth noting that Walmart once had a chance to be a leader in online sales. Back in 1999, just five years after Amazon was born, Walmart launched its own website. At one point, then-Walmart CEO Lee Scott even invited Jeff Bezos to his house in Bentonville, Ark., to chat about acquiring Amazon, according to “The Everything Store” by Brad Stone. Instead, Bezos offered to run Walmart’s website. The talks fizzled fast.

Years of disbelief that online shopping would really take off and a fierce interest in placing brick and mortar Walmart stores around the world gave way to neglect. Meanwhile, Amazon raced ahead without the same demands to churn out profits, offering low price products and faster service that would hook consumers and drive loyalty. As Amazon expanded into music, media, and web services, its customers hung on tighter.

Meanwhile, growth prospects in Walmart’s core business have dimmed. The store chain has oversaturated the US with superstores at a time when consumer preferences seem to have shifted to smaller convenience stores. Its international expansion has bogged down in key markets like China and India. And despite big investments in e-commerce, its sales still lag those of retailers like Amazon and Staples.

Of course, it’s worth noting there are many ways to measure size. And Walmart remains one of the world’s largest non-government economic entities.

Walmart’s annual sales—$486 billion last year—continue to dwarf Amazon’s $89 billion. (Walmart’s revenues are the largest in the world.)

And Walmart’s 2.2 million employees make it the world’s largest private sector employer.

In fact, it’s the third largest employer overall, just behind the People’s Liberation of Army of China.